MultiChoice has announced that it will air the Canal+ licensed series ‘King & Conqueror’, which airs in more than 40 countries across Europe and Africa.

“M-Net is thrilled to participate in this significant global content launch, which marks our first collaboration with Canal+,” stated Waldimar Pelser, director of premium channels at MultiChoice.

“King & Conqueror is a powerful and ambitious epic narrative, and we believe it will strongly resonate with audiences in South Africa and beyond.”

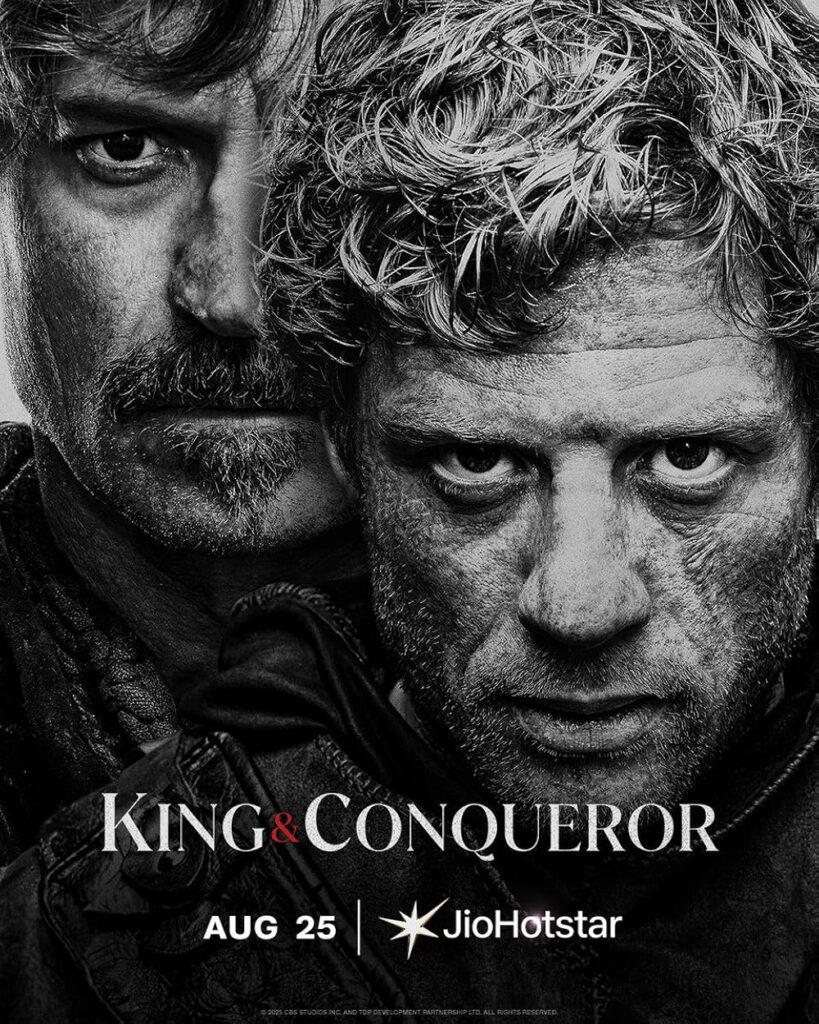

The series centres on the historical conflict between Harold of Wessex and William of Normandy as they compete for the English throne following King Edward’s death in 1066, culminating in the famous Battle of Hastings.

Starring in the production are James Norton, known for his roles in Happy Valley and Playing Nice, alongside Nikolaj Coster-Waldau from Game of Thrones. The cast features other notable actors, including Emily Beecham, Clémence Poésy, Juliet Stevenson, Eddie Marsan, and Jean-Marc Barr. The premiere episode aired on Thursday, February 12, 2026, at 21:00 on M-Net.

Groupe Canal+ gained control of MultiChoice in September 2025, with the final phase of the acquisition completed on October 13 of the same year.

As part of Canal+ Africa, MultiChoice’s CEO, David Mignot, previously remarked that DStv subscribers can look forward to a combined content library from Canal+ and MultiChoice, ushering in a wealth of new content.

“MultiChoice’s offerings are exceptional. We can harness the strengths of both groups,” he commented. “Customers will have access to everything Canal+ has to offer. We possess a vast library of European content and a substantial collection of American titles, totalling around 9,000 films.”

Mignot highlighted that Canal+ produces approximately 4,000 hours of African content annually, available in up to 15 languages, which DStv subscribers will also gain access to, in addition to MultiChoice’s annual output of 6,000 hours of local content.

“Together, we aim to provide nearly 10,000 hours of content each year in 20 to 35 languages,” Mignot stated. “Over the next 10 to 15 years, we are building a catalogue that could reach between 100,000 and 150,000 hours, allowing for increased content mobility.”

Recently, Canal+ revealed its cost-cutting objectives, targeting run-rate cost synergies of US$400 million in earnings before interest, tax, and amortisation (EBITA) by 2030. The company also aims to achieve free cash flow synergies (FCF) of US$300 million by that same year. Canal+ CEO Maxime Saada expressed confidence in achieving these goals.

The media conglomerate is pursuing EBITA and FCF cost efficiencies exceeding US$150 million in 2026, with expectations to rise to US$300 million and US$250 million, respectively, by 2028.

“Our expanded scale will allow us to generate significant synergies, particularly concerning our cost structure,” Saada explained. “We are well-positioned to take advantage of growth opportunities in Africa.”

Despite Canal+ experiencing enhanced economies of scale following its acquisition of MultiChoice, Saada emphasised his enthusiasm for the promising growth prospects ahead. With the acquisition of MultiChoice, which had approximately 14 million subscribers, Canal+ has expanded its total subscriber base to around 40 million across Europe and Africa.

Canal+ acknowledged that MultiChoice’s subscriber count peaked at approximately 23.5 million in the 2023 fiscal year but has since declined. Nevertheless, they believe their current standing equips them to help MultiChoice regain its pre-2023 growth trajectory.

“Leveraging its strong position across the continent, the combined Group has initiated a comprehensive action plan to restore growth in MultiChoice markets,” Canal+ reported.

Actions already undertaken since taking control of MultiChoice have reportedly secured over US$80 million in FCF synergies for 2026, including new content partnerships, renegotiation of hardware sourcing, infrastructure optimisation, and refinancing of MultiChoice Group’s long-term liabilities.